Years ago, during the Great Financial Crisis of 2008-2009, a client asked me: “where does money go when the stock market declines?” I thought about it for a minute, and responded facetiously, “Money Heaven.” Meaning that it vanishes and leaves this world. Literally. Since I uttered those words, the idea of money heaven resonates with me increasingly.

Money serves three basic functions in the economy. It is: 1) A medium of exchange, 2) A store of value, and 3) A unit of account. When we are thinking about money heaven, it is really money’s role as a unit of account that we are addressing.

Let’s break this down. Suppose you have $10,000 and choose to invest it in investment X. If investment X is valued $100 per share and you buy 100 units of it, then you placed your $10,000 in 100 units. No matter the dollar price for that asset, you will always have 100 units. The units may go up or down in value, but you will ALWAYS have 100 units (so long as you don’t sell it or it doesn’t split.) The value of your investment over time determines whether that investment creates money value or destroys it. Suppose in the example above, that your investment drops in value from $100 to $50, then your 100 units are now worth $5,000. The other $5,000 is in “money heaven.”

Before tackling money heaven, let’s address where money originates—how it is “born.” Many people might struggle with the concepts of money creation. Money creation occurs through the “banking system” in the United States. The US Federal Reserve controls the banking system and the creation of money. There are multiple mechanisms that the Fed can use to “create” money. But before getting into money creation, it is vitally important to understand two basic forms of money.

The two basic forms of money are: 1) Fiat money, and 2) Representative money.

- Fiat money is composed of bills and coin that are printed or forged by the US Treasury. The US treasury creates fiat every year based on the Fed’s forecast of 1) how much demand they expect, 2) how much currency they expect that Reserve Banks will destroy because the notes are unfit to circulate, and 3) other factors, such as inventory management or the issuance of a new design. Most of us think of fiat money when we think of money—the stuff we can hold in our hands.

- Representative money exists in the form of a digital representation that is backed by an “asset” such as gold (or any commodity) or backed by an extension of credit. IMPORTANT POINT: The Fed creates money through representative money mechanisms as opposed to printing fiat money. The Fed prints Fiat money through the US treasury merely at a level to ensure there is enough in circulation to facilitate buying and selling.

The Fed uses multiple mechanisms to create representative (digital) money. 1) It sets the discount rate which is the rate that member banks borrow money from the Fed. Presently the discount rate is 25 basis points. The lower discount rate, the lower the rates banks pay for deposits and charge for all types of loans. 2) It sets the Fed funds rate which is the rate that member banks borrow from one another. The discount rate is currently set at a range of 25-50 basis points and the effective rate is 33 basis points. 3) It sets the reserve requirement for banks. The lower the reserve requirement, the more money banks lend, which puts more digital money in circulation. The current reserve requirement is zero. 4) It engages in open market operations by purchasing and selling assets held on its balance sheet. The bigger the balance sheet, the more representative money in circulation. The balance sheet is presently at almost nine trillion dollars.

Money can also be “created” through fiscal policy and US treasury direct deposits into US citizen bank accounts. These measures were taken in response to the Covid-related economic shutdown which directly added to the digital monetary base.

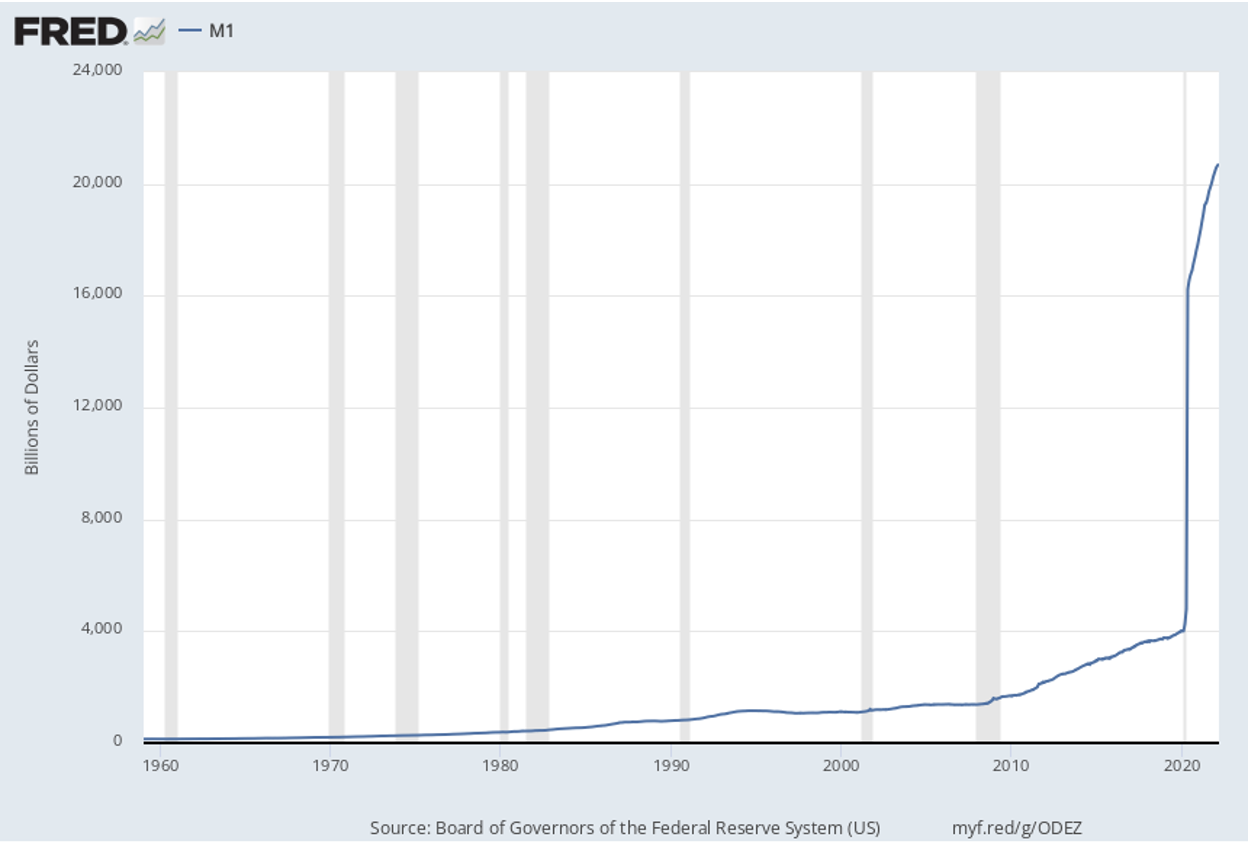

With all this said, below is a picture of the current money stock that the Fed has created in the past few years:

This is almost $21 trillion in liquid money, up from $4 trillion just prior to Covid! There is no other way to look at it than it is a HUGE amount. The big questions are 1) How does the Fed know what is the proper amount to print? 2) what happens within the economy when the Fed prints this much money? 3) What happens if the Fed prints too much?

When the Fed prints this much new money, the money seeks places to go through consumer choices: spending, saving, and investing. It is safe to say ALL these things happened in good measure with the extra money the Fed printed. To what effect? During this time, we have seen savings increase, consumer spending continue, and the price of all kinds of assets reach new all-time highs—from stocks, to houses, to cryptocurrency, and to other less than serious things like NFTs. We have also seen inflation take off during this time to reach levels not seen in 40 years. Certainly, the inflation we are seeing today is the direct consequence of the Fed’s printing too much money. It may also be due to factors such as supply chain and disruptions, but the oversupply of money is almost certainly the predominant factor.

Which brings us back to money heaven and money’s role as a unit of account. Once all the excess money has worked its way into the economy, how money goes to heaven begins to manifest. Dropping asset values is one way money goes to heaven. When this episode is over, we still have the same number of stock shares, we will have the same number of houses, and we will have the same number of bitcoins; but their value will have found a new equilibrium. We will have less money. A sneakier way money goes to heaven is through inflationary pressures. When more money is required to buy the same thing, it means that money is worth “less.” Even if we try to avoid asset value declines by raising cash, the money itself loses its value through inflation. This is all happening now and there isn’t really a good place to hide without taking undue risks.

Through all these mechanisms, the value of the money stock drops or loses some purchasing power (or value). I believe all of them are at work in the economy today because there is too much money relative to true economic activity. On top of this, we are now confronting a slowing economy and the real possibility of recession. How far does it go? How long does it last? When do we return to “normal?” These are all great questions; the answers to which we are watching closely. We are monitoring money supply, inflation, economic output, corporate earnings, and the aggregate value of assets to get clues about these things.

In the meantime, we continue to diligently manage the assets you have entrusted to our care, paying close attention to valuations, current income, and prudent diversification. We are looking at all alternatives and considering their potential use. Eventually, things related to money supply and economic activity will normalize, and wealth creation will resume within the American economy. It is also important to point out that in the midst of all the things discussed herein related to US money values, the dollar is presently appreciating against almost all other currencies around the world. Warren Buffett said it best when he said “never bet against America.”

We thank you for your business and encourage you to ask questions of your advisor should you have them.